UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________

SCHEDULE

(Amendment No. 1)

__________________________________________

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

Filed by the Registrant |

☒ |

|

|

Filed by a Party other than the Registrant |

☐ |

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified in its Charter)

______________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Explanatory Note

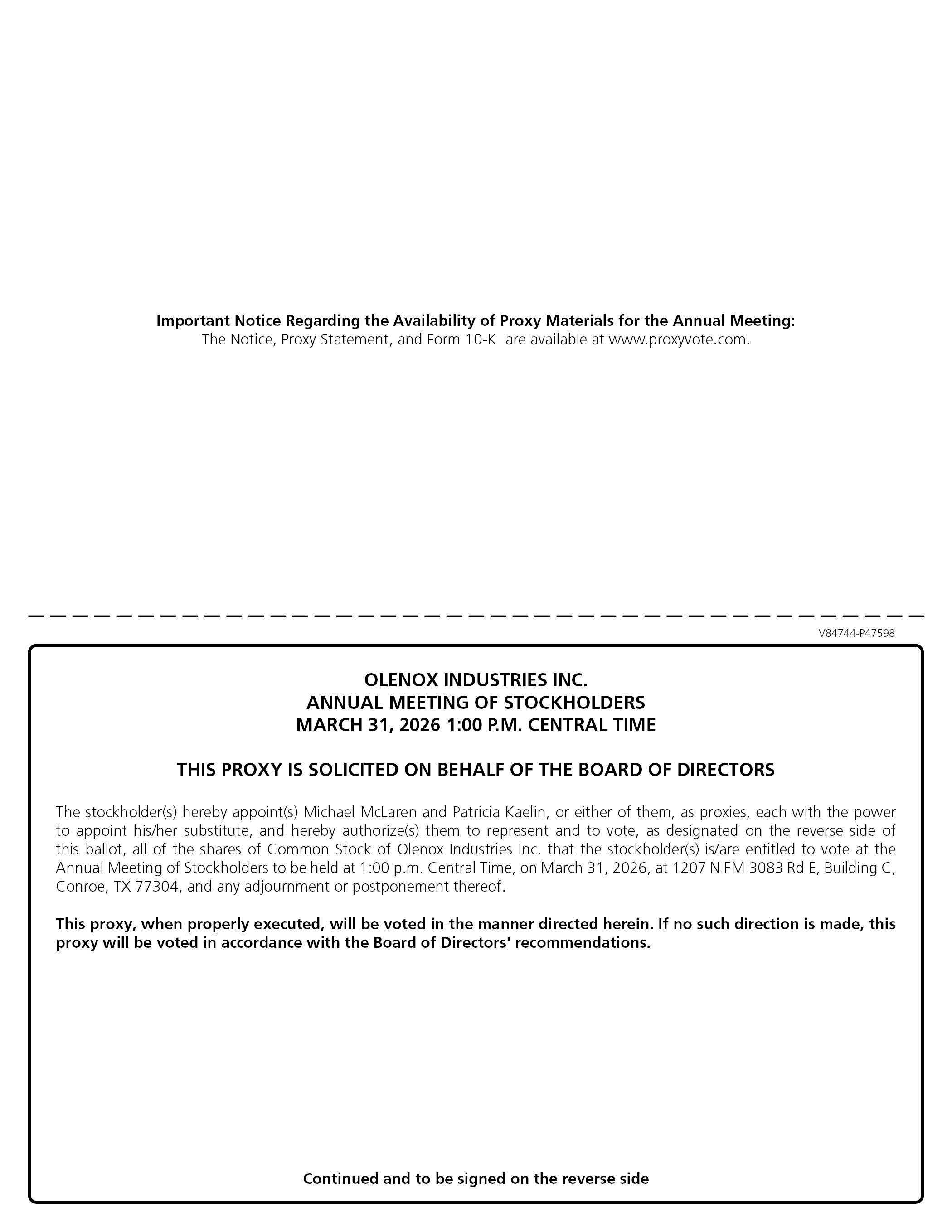

This Amendment No. 1 (this “Amendment”) amends the definitive proxy statement of Olenox Industries Inc. (formerly known as Safe & Green Holdings Corp.) (“we”, “our”, or the “Company”) filed with the Securities and Exchange Commission on December 19, 2025 (the “Proxy Statement”). The Proxy Statement was filed in connection with the Company’s 2025 annual meeting of stockholders (the “2025 Annual Meeting”) that was convened on December 29, 2025, reconvened on January 14, 2026, reconvened on January 28, 2026, and has subsequently been adjourned until March 31, 2026 at 1:00 p.m. Central Daylight Time (the “Adjourned Meeting Date”).

This Amendment is being filed to (i) provide an amended notice notifying the Company’s stockholders of a new record date, location, and Adjourned Meeting Date for the 2025 Annual Meeting, (ii) amend and restate Proposal 2, the proposal for ratification of our independent registered public accounting firm for our fiscal year ending December 31, 2025, (iii) include a new Proposal 8, related to the approval, for purposes of Nasdaq Listing Rule 5635(d), the issuance of securities in connection with the Series C Convertible Preferred Stock financing, (iv) include a new Proposal 9, related to the approval of a reverse stock split of the Company’s common stock, (v) correct certain clerical errors in Proposal 6, (vi) remove the prior Proposal 4, related to the advisory vote on the frequency of the advisory vote on executive compensation proposal, and the prior Proposal 8, related to a proposed amendment to the Company’s amended and restated bylaws, (vii) include other disclosures intended to comply with the requirements of Schedule 14A, and (viii) reflect the new name of the Company, Olenox Industries Inc. (formerly known as Safe & Green Holdings Corp.) and the new ticker symbol of the Company, OLOX (formerly SGBX). This Amendment restates the Proxy Statement in its entirety. We will print and distribute this Amendment to our stockholders as of February 11, 2026, the record date for determining the stockholders entitled to notice of and to vote at the 2025 Annual Meeting.

Capitalized terms used but not otherwise defined in this Amendment have the meanings ascribed to them in the Proxy Statement. This Amendment should be read together with the Proxy Statement, and the information contained in this Amendment modifies or supersedes any inconsistent material contained in the Proxy Statement.

Except as specifically discussed in this Explanatory Note, this Amendment does not modify or update any other disclosures in the Proxy Statement. In addition, this Amendment does not reflect events occurring after the date of the Proxy Statement or modify or update disclosures that may have been affected by subsequent events.

Olenox Industries Inc.

1207 N. FM 3083 E. Bldg C

Conroe, Texas 77304

AMENDED NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on March 31, 2026

NOTICE IS HEREBY GIVEN that the 2025 Annual Meeting of Stockholders (the “2025 Annual Meeting”) of Olenox Industries Inc. (formerly known as Safe & Green Holdings Corp.) (the “Company”) has been adjourned to March 31, 2026, at 1:00 P.M. Central Time, and will be held at 1207 N FM 3083 Rd E, Building C, Conroe, TX 77304 for the following purposes:

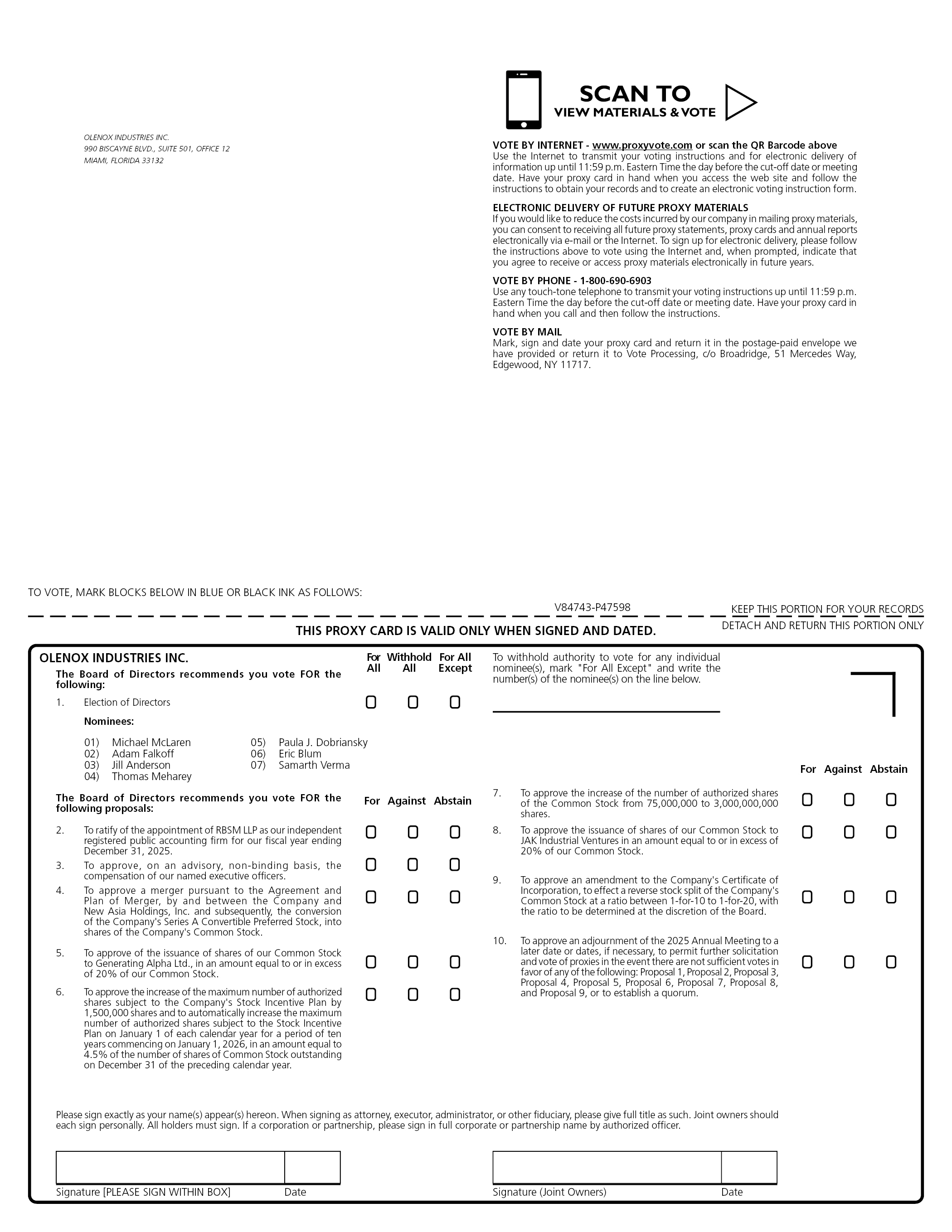

(1) to elect the seven nominees for director named in the accompanying proxy statement to our Board of Directors, each to serve a one-year term expiring at the 2026 Annual Meeting of Shareholders and until such director’s successor is duly elected and qualified (the “Election of Directors Proposal”);

(2) to ratify the appointment of RBSM LLP, as our independent registered public accounting firm for our fiscal year ending December 31, 2025 (the “Auditor Ratification Proposal”);

(3) to approve, on an advisory, non-binding basis, the compensation of our named executive officers (the “Advisory Vote on Executive Compensation Proposal”);

(4) to approve, the merger pursuant to the terms of the Agreement and Plan of Merger, dated February 2, 2025, by and between the Company and New Asia Holdings, Inc., and subsequently, the conversion of the Company’s Series A Convertible Preferred Stock, par value $1.00 (the “Preferred Stock”), into shares of the Company’s common stock, par value $0.01 per share the (the “Common Stock”), whereby each share of Series A Convertible Preferred Stock converts into fifteen (15) shares of Common Stock (the “Merger Proposal”);

(5) to approve in compliance with Nasdaq Rule 5635(d), the issuance of shares of our Common Stock, pursuant to those certain securities purchase agreements, dated as of March 27, 2025, April 11, 2025, and May 29, 2025, respectively, in each case by and between the Company and Generating Alpha Ltd., in an amount equal to or in excess of 20% of our Common Stock outstanding immediately prior to the issuance of such shares (the “Generating Alpha Issuance Proposal”);

(6) to increase the maximum number of authorized shares subject to the SG Blocks, Inc. Stock Incentive Plan, as amended from time to time (as amended, the “Stock Incentive Plan”), by 1,500,000 shares and to automatically increase the maximum number of authorized shares subject to the Stock Incentive Plan on January 1 of each calendar year for a period of ten years commencing on January 1, 2026, in an amount equal to 4.5% of the number of shares of Common Stock outstanding on December 31 of the preceding calendar year (the “Incentive Plan Increase Proposal”);

(7) to amend the articles of incorporation to increase the authorized shares of Common Stock from 75,000,000 shares to 3,000,000,000 shares (the “Authorized Common Stock Increase Proposal”);

(8) to approve, in compliance with Nasdaq Rule 5635(d) the issuance of shares of our Common Stock, pursuant that certain Securities Purchase Agreement, dated as of November 25, 2025, by and between the Company and JAK INDUSTRIAL VENTURES I LLC, in an amount equal to or in excess of 20% of our Common Stock outstanding immediately prior to the issuance of such shares (the “Series C Conversion Proposal”);

(9) to approve an amendment to the Company’s Certificate of Incorporation, in substantially the form attached to the accompanying proxy statement as Appendix D, to effect a reverse stock split with respect to the Company’s issued and outstanding common stock, par value $0.01 per share, including stock held by

the Company as treasury shares, at a ratio of 1-for-10 to 1-for-20, with the ratio within such range to be determined at the discretion of the Board and included in a public announcement, subject to the authority of the Board of Directors to abandon such amendment; and

(10) to approve one or more adjournments of the 2025 Annual Meeting, if necessary or appropriate, to solicit additional proxies in favor of the Proposals listed hereinabove, if there are not sufficient votes at the 2025 Annual Meeting to approve and adopt the Proposals listed hereinabove (the “Adjournment Proposal”).

The Proxy Statement accompanying this amended notice describes each of these items of business in detail. The Board of Directors has fixed the close of business on February 11, 2026 as the record date for the determination of stockholders entitled to notice of and to vote at the 2025 Annual Meeting and any adjournments or postponements of the 2025 Annual Meeting. Accordingly, only stockholders of record at the close of business on February 11, 2026 are entitled to notice of, and to vote at, the 2025 Annual Meeting and any adjournments or postponements of the 2025 Annual Meeting.

Your vote is important. Whether or not you expect to attend the 2025 Annual Meeting, please vote via the Internet, by telephone, or complete, date, sign and promptly return the enclosed proxy card so that your shares may be represented at the meeting.

|

By Order of the Board of Directors, |

||

|

/s/ Michael McLaren |

||

|

Michael McLaren |

||

|

Chairman of the Board |

||

|

Miami, Florida |

||

|

February 13, 2026 |

IMPORTANT: WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING OF THE STOCKHOLDERS, WE ASK YOU TO VOTE BY TELEPHONE, MAIL, FAX OR ON THE INTERNET USING THE INSTRUCTIONS PROVIDED IN THE ENCLOSED PROXY CARD.

TABLE OF CONTENTS

|

PAGE |

||

|

1 |

||

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

8 |

|

|

9 |

||

|

20 |

||

|

21 |

||

|

FEES PAID TO THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

22 |

|

|

PROPOSAL 3: THE ADVISORY VOTE ON EXECUTIVE COMPENSATION PROPSAL |

23 |

|

|

24 |

||

|

26 |

||

|

31 |

||

|

37 |

||

|

39 |

||

|

41 |

||

|

48 |

||

|

49 |

||

|

50 |

||

|

53 |

||

|

TRANSACTIONS WITH RELATED PERSONS, PROMOTERS AND CERTAIN CONTROL PERSONS |

57 |

|

|

61 |

||

|

61 |

||

|

61 |

||

|

62 |

||

|

APPENDICES |

||

|

A-1 |

||

|

B-1 |

||

|

C-1 |

||

|

D-1 |

i

Olenox Industries Inc.

1207 N. FM 3083 E. Bldg C

Conroe, Texas 77304

PROXY STATEMENT

For the 2025 Annual Meeting of Stockholders to be reconvened on March 31, 2026

ABOUT THE MEETING

Why am I receiving this Proxy Statement?

This Proxy Statement contains information related to the solicitation of proxies for use at our 2025 Annual Meeting, to be held at 1207 N FM 3083 Rd E, Building C, Conroe, TX 77304 on March 31, 2026, at 1:00 P.M. Central Time for the purposes stated in the accompanying Amended Notice of 2025 Annual Meeting (the “Notice”). This solicitation is made by our Board of Directors (also referred to as the “Board” in this Proxy Statement) on behalf of Olenox Industries Inc. (formerly known as Safe & Green Holdings Corp.). In this Proxy Statement, the terms “we,” “our,” “us” and the “Company” refer to Olenox Industries Inc.

On or about February 23, 2026, we are mailing the Notice, along with this Proxy Statement and accompanying proxy card, which includes voting instructions, to all stockholders entitled to notice of and to vote at the 2025 Annual Meeting. Whether or not you expect to attend the 2025 Annual Meeting, please read these materials carefully, complete, sign and date the enclosed proxy card and return it promptly, or complete and submit your proxy via phone or the Internet in accordance with the instructions provided on the enclosed proxy card.

The Notice, this Proxy Statement and the accompanying form of proxy card are available at www.proxyvote.com. You are encouraged to access and review all of the important information contained in the proxy materials before voting.

IMPORTANT NOTE REGARDING THE SEPTEMBER 2025 REVERSE STOCK SPLIT: On September 8, 2025, we effected a 1-for-64 reverse stock split of our then-outstanding Common Stock (the “September 2025 Reverse Stock Split”). Accordingly, all share and per share amounts for all periods presented in this Proxy Statement have been retroactively adjusted to reflect the September 2025 Reverse Stock Split. In addition, all equity awards, warrants, and debenture outstanding immediately prior to the September 2025 Reverse Stock Split were proportionately adjusted.

What am I being asked to vote on?

You are being asked to vote on the following proposals:

• Proposal 1 (Election of Directors): to elect the seven (7) nominees for director named in the accompanying proxy statement to our Board of Directors, each to serve a one-year term and until such director’s successor is duly elected and qualified (the “Election of Directors Proposal”).

• Proposal 2 (Auditor Ratification): to ratify the appointment of RBSM LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2025 (the “Auditor Ratification Proposal”).

• Proposal 3 (Advisory Vote on Executive Compensation): to approve, on an advisory, non-binding basis, the compensation of our named executive officers (the “Advisory Vote on Executive Compensation Proposal”).

• Proposal 4 (Merger): to approve the merger pursuant to the terms of the Agreement and Plan of Merger, dated February 2, 2025, by and between the Company and New Asia Holdings, Inc. (the “Merger Agreement”), and subsequently, the conversion of the Company’s Series A Convertible Preferred Stock,

1

par value $1.00 (the “Preferred Stock”), into shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”), whereby each share of Series A Convertible Preferred Stock converts into fifteen (15) shares of Common Stock (the “Merger Proposal”).

• Proposal 5 (Generating Alpha Issuance): to approve the issuance of shares of our Common Stock, pursuant to those certain securities purchase agreements, dated as of March 27, 2025, April 11, 2025, and May 29, 2025, respectively, in each case by and between the Company and Generating Alpha Ltd., in an amount equal to or in excess of 20% of our Common Stock outstanding immediately prior to the issuance of such shares (the “Generating Alpha Issuance Proposal”).

• Proposal 6 (Incentive Plan Increase): to approve the increase of the maximum number of authorized shares subject to the Company’s Stock Incentive Plan, as amended from time to time (as amended, the “Stock Incentive Plan”), by 1,500,000 shares and to automatically increase the maximum number of authorized shares subject to the Stock Incentive Plan on January 1 of each calendar year for a period of ten years commencing on January 1, 2026, in an amount equal to 4.5% of the number of shares of Common Stock outstanding on December 31 of the preceding calendar year (the “Incentive Plan Increase Proposal”).

• Proposal 7 (Authorized Common Stock Increase): to approve the increase of the number of authorized shares of the Common Stock from 75,000,000 to 3,000,000,000 shares (the “Authorized Common Stock Increase Proposal”).

• Proposal 8 (Series C Conversion): to approve, in compliance with Nasdaq Rule 5635(d) the issuance of shares of our Common Stock, pursuant that certain Securities Purchase Agreement, dated as of November 25, 2025, by and between the Company and JAK INDUSTRIAL VENTURES I LLC, in an amount equal to or in excess of 20% of our Common Stock outstanding immediately prior to the issuance of such shares (the “Series C Conversion Proposal”).

• Proposal 9 (Reverse Stock Split): to approve an amendment to the Company’s Certificate of Incorporation, in substantially the form attached to the accompanying proxy statement as Appendix D, to effect a reverse stock split with respect to the Company’s issued and outstanding common stock, par value $0.01 per share, including stock held by the Company as treasury shares, at a ratio of 1-for-10 to 1-for-20, with the ratio within such range to be determined at the discretion of the Board and included in a public announcement, subject to the authority of the Board of Directors to abandon such amendment (the “Reverse Stock Split Proposal”).

• Proposal 10 (Adjournment): to approve an adjournment of the 2025 Annual Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event there are not sufficient votes in favor of any of the following: Proposal 1, Proposal 2, Proposal 3, Proposal 4, Proposal 5, Proposal 6, Proposal 7, Proposal 8, and Proposal 9, or to establish a quorum (the “Adjournment Proposal”).

To transact any other business that may properly come before the 2025 Annual Meeting or any adjournment(s) or postponements of the 2025 Annual Meeting.

What are the Board’s voting recommendations?

The Board recommends that you vote as follows:

• Proposal 1 (Election of Directors Proposal): “FOR” the Election of Directors Proposal

• Proposal 2 (Auditor Ratification Proposal): “FOR” the Auditor Ratification Proposal

• Proposal 3 (Advisory Vote on Executive Compensation Proposal): “FOR” the Advisory Vote on Executive Compensation Proposal

• Proposal 4 (Merger Proposal): “FOR” the Merger Proposal

• Proposal 5 (Generating Alpha Issuance Proposal): “FOR” the Generating Alpha Issuance Proposal

• Proposal 6 (Incentive Plan Increase Proposal): “FOR” the Incentive Plan Increase Proposal

2

• Proposal 7 (Authorized Common Stock Increase Proposal): “FOR” the Authorized Common Stock Increase Proposal

• Proposal 8 (Series C Conversion Proposal): “FOR” the Series C Conversion Proposal

• Proposal 9 (Reverse Stock Split Proposal): “FOR” the Reverse Stock Split Proposal

• Proposal 10 (Adjournment Proposal): “FOR” the Adjournment Proposal

Who is entitled to vote at the 2025 Annual Meeting?

Holders of record of our Common Stock, as of the close of business on February 11, 2026, the record date for the 2025 Annual Meeting (the “Record Date”), are entitled to receive notice of the 2025 Annual Meeting. Holders of record shares of our Common Stock have the right to vote on all matters brought before the 2025 Annual Meeting.

As of the Record Date, there were 9,609,436 shares of our Common Stock were issued and outstanding.

What are the voting rights of stockholders?

Each share of our 9,609,436 Common Stock outstanding as of the Record Date, is entitled to receive notice of the 2025 Annual Meeting and to one vote per share on all matters properly brought before the 2025 Annual Meeting.

No dissenters’ rights are provided under the Delaware General Corporation Law, our Charter or our Second Amended and Restated Bylaws (the “Bylaws”) with respect to any of the proposals described in this Proxy Statement.

Who can attend the 2025 Annual Meeting?

All holders of our Common Stock at the close of business on the Record Date, or their duly appointed proxies, may attend the 2025 Annual Meeting. If you attend the 2025 Annual Meeting in person, you will be asked to present photo identification (such as a state-issued driver’s license) and proof of your ownership of shares of Common Stock before entering the meeting. Please note that if you hold shares in “street name” (through a bank or broker, for example), you will need to bring a recent brokerage statement or a letter from your broker or bank reflecting your ownership of our Common Stock as of the Record Date. If you want to vote shares you hold in street name in person at the 2025 Annual Meeting, you must bring a legal proxy in your name from the broker, bank or other nominee that holds your shares.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Many stockholders hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

• Stockholder of record. If your shares are registered directly in your name with our transfer agent, Vinyl Equity, Inc., you are considered the stockholder of record of those shares, and the Notice is being sent directly to you by us.

• Beneficial owner of shares held in street name. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of shares held in “street name,” and the Notice is being forwarded to you by your broker or nominee, which is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker how to vote your shares and are also invited to attend the 2025 Annual Meeting.

What will constitute a quorum at the 2025 Annual Meeting?

A quorum is the minimum number of shares required to be present in person or represented by proxy at the 2025 Annual Meeting to properly hold a meeting of stockholders and conduct business under our Bylaws and Delaware law. The presence at the meeting, in-person or by proxy, of the holders of one-third of the voting power of the stock issued, outstanding and entitled to vote at the 2025 Annual Meeting on the Record Date, will constitute a quorum, permitting our stockholders to conduct business at the 2025 Annual Meeting. We will include abstentions and broker non-votes

3

in the calculation of the number of shares considered to be present at the meeting for purposes of determining the presence of a quorum at the meeting. As of the Record Date, there were 9,609,436 shares of our Common Stock outstanding.

If a quorum is not present to transact business at the 2025 Annual Meeting or if we do not receive sufficient votes in favor of the proposals by the date of the 2025 Annual Meeting, the chairperson of the 2025 Annual Meeting or the vote of the stockholders entitled to vote the shares present at the meeting in person or represented by proxy may adjourn the 2025 Annual Meeting to another time and place.

What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote at the 2025 Annual Meeting or by completing your proxy card or submitting your proxy via the Internet or by telephone, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner and do not instruct your broker, bank, or other nominee how to vote your shares, the question of whether your broker will still be able to vote your shares depends on whether the New York Stock Exchange (the “NYSE”) deems the particular proposal to be a “routine” matter. Although our shares of Common Stock are listed with Nasdaq, the NYSE regulates broker-dealers and their discretion to vote on stockholder proposals. Brokers can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the NYSE, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholder, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation), and certain corporate governance proposals, even if management-supported. We believe that Proposals 1, 3, 4, 5, 6, and 8 will be treated by the NYSE as non-routine matters and Proposals 2, 7, 9, and 10 will be treated by the NYSE as routine matters. Accordingly, your broker may register your shares as being present at the 2025 Annual Meeting for purposes of determining the presence of a quorum, but not vote your shares on Proposals 1, 3, 4, 5, 6, and 8 without your instructions (referred to as “broker non-votes”), but may vote your shares on Proposals 2, 7, 9, and 10 even in the absence of your instruction. This belief is based on preliminary guidance from the NYSE and may be incorrect or change before the 2025 Annual Meeting.

How many votes are needed for the proposals to pass?

The proposals to be voted on at the 2025 Annual Meeting have the following voting requirements:

• Proposal 1 (Election of Directors Proposal): For the Election of Directors Proposal, the 7 director nominees named herein receiving the highest number of FOR votes (from the holders of shares present or represented by proxy at the 2025 Annual Meeting and entitled to vote on the election of directors) will be elected. You may vote either FOR all of the nominees, WITHHOLD your vote from all of the nominees or WITHHOLD your vote from any one of the nominees. Only votes FOR will affect the outcome. Withheld votes and broker non-votes, if any, will have no effect on the outcome of the vote as long as each nominee receives at least one FOR vote. You do not have the right to cumulate your votes.

• Proposal 2 (Auditor Ratification Proposal): To be approved, the Auditor Ratification Proposal must receive the affirmative vote of a majority of the shares of the Company’s Common Stock, present in person or represented by proxy at the 2025 Annual Meeting and entitled to vote thereon. Abstentions, which are considered present and entitled to vote on this matter, will have the same effect as a vote AGAINST this proposal. Broker non-votes are not expected for this proposal because we believe this matter is a routine matter. Proposal 2 is an advisory vote, and therefore is not binding on us, the Audit Committee of the Board (the “Audit Committee”) or the Board. If our stockholders do not approve the Auditor Ratification Proposal, the Audit Committee will reconsider whether to retain that firm. Even if the Auditor Ratification Proposal is approved, the Audit Committee in its discretion may direct the appointment of different independent auditors at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

4

• Proposal 3 (Advisory Vote on Executive Compensation Proposal): To be approved, the Advisory Vote on Executive Compensation Proposal must receive the affirmative vote of a majority of the shares of the Company’s Common Stock, present in person or represented by proxy at the 2025 Annual Meeting and entitled to vote thereon. Abstentions, which are considered present and entitled to vote on this matter, will have the same effect as a vote AGAINST this proposal. Broker non-votes, if any, will have no effect on the vote with respect to this proposal. Proposal 3 is an advisory vote, and therefore is not binding on us, the Compensation Committee of the Board (the “Compensation Committee”) or the Board. However, the Board and the Compensation Committee value the opinion of our stockholders and will consider our stockholders’ opinion when making future compensation decisions for our named executive officers.

• Proposal 4 (Merger Proposal): To be approved, the Merger Proposal must receive the affirmative vote of a majority of the shares of the Common Stock entitled to vote thereon. Abstentions and broker non-votes will have the same effect as a vote AGAINST this proposal.

• Proposal 5 (Generating Alpha Issuance Proposal): To be approved, the Generating Alpha Issuance Proposal must receive the affirmative vote of a majority of the shares of Common Stock, present in person or represented by proxy at the 2025 Annual Meeting and entitled to vote thereon. Abstentions, which are considered present and entitled to vote on this matter, will have the same effect as a vote AGAINST this proposal. Broker non-votes, if any, will have no effect on the vote with respect to this proposal.

• Proposal 6 (Incentive Plan Increase Proposal): To be approved, the Incentive Plan Increase Proposal must receive the affirmative vote of a majority of the shares of Common Stock, present in person or represented by proxy at the 2025 Annual Meeting and entitled to vote thereon. Abstentions, which are considered present and entitled to vote on this matter, will have the same effect as a vote AGAINST this proposal. Broker non-votes, if any, will have no effect on the vote with respect to this proposal.

• Proposal 7 (Authorized Common Stock Increase Proposal): To be approved, the Authorized Common Stock Increase Proposal must receive the affirmative vote of a majority of the votes cast by the holders of all shares of Common Stock present in person or represented by proxy at the 2025 Annual Meeting and entitled to vote thereon. Since abstentions are not considered votes cast, they will have no effect on this proposal. Broker non-votes are not expected for this proposal because we believe this matter is a routine matter.

• Proposal 8 (Series C Conversion Proposal): To be approved, the Series C Conversion Proposal must receive the affirmative vote of a majority of the shares of Common Stock, present in person or represented by proxy at the 2025 Annual Meeting and entitled to vote thereon. Abstentions, which are considered present and entitled to vote on this matter, will have the same effect as a vote AGAINST this proposal. Broker non-votes, if any, will have no effect on the vote with respect to this proposal.

• Proposal 9 (Reverse Stock Split Proposal): To be approved, the Reverse Stock Split Proposal must receive the affirmative vote of a majority of the votes cast by the holders of all shares of Common Stock present in person or represented by proxy at the 2025 Annual Meeting and entitled to vote thereon. Since abstentions are not considered votes cast, they will have no effect on this proposal. Broker non-votes are not expected for this proposal because we believe this matter is a routine matter.

• Proposal 10 (Adjournment Proposal): To be approved, the Adjournment Proposal must receive the affirmative vote of a majority of the shares of Common Stock, present in person or represented by proxy at the 2025 Annual Meeting and entitled to vote thereon. Abstentions, which are considered present and entitled to vote on this matter, will have the same effect as a vote AGAINST this proposal. Broker non-votes are not expected for this proposal because we believe this matter is a routine matter.

5

Will any other matters be voted on?

As of the date of this Proxy Statement, we are not aware of any matters that will come before the 2025 Annual Meeting other than those disclosed in this Proxy Statement. If any other matters are properly brought before the 2025 Annual Meeting, the persons named in the accompanying proxy card will vote the shares represented by the proxies on the other matters in the manner recommended by the Board, or, if no such recommendation is given, in the discretion of the proxy holders.

How do I vote?

• Stockholders of record: If your shares are registered directly in your name with our transfer agent, Vinyl Equity, Inc., as of the Record Date, you may submit your proxy by U.S. mail, Internet or by following the instructions provided on the enclosed proxy card. The deadline for submitting your vote by Internet is 11:59 p.m. Eastern Time on March 30, 2026, which is the day before the 2025 Annual Meeting. The designated proxy holders named in the proxy card will vote according to your instructions. You may also attend and vote at the 2025 Annual Meeting.

• Beneficial owner of shares held in street name: If you are a street name or beneficial stockholder because your shares are held in a brokerage account or by a bank or other nominee, your broker or nominee firm will provide you with the proxy materials, together with a voting instruction card. Follow the instructions provided by your broker or nominee firm by referring to the voting instruction card so that you can instruct your broker or nominee how to vote your shares.

If you sign and submit your proxy card without specifying how you would like your shares voted, your shares will be voted in accordance with the Board’s recommendations specified above under “What are the Board’s voting recommendations?” and in accordance with the discretion of the proxy holders with respect to any other matters that may be voted upon at the 2025 Annual Meeting.

If I plan to attend the 2025 Annual Meeting, should I still vote by proxy?

Yes. Voting in advance does not affect your right to attend the 2025 Annual Meeting. If you send in your proxy card and also attend the 2025 Annual Meeting, you do not need to vote again at the 2025 Annual Meeting unless you want to change your vote.

All stockholders as of the record date are welcome to attend the 2025 Annual Meeting. If you attend, please note that you will be asked to present government-issued identification (such as a driver’s license or passport) and evidence of your share ownership of our Common Stock on the record date. This can be your proxy card if you are a stockholder of record. If your shares are held beneficially in the name of a bank, broker or other holder of record and you plan to attend the 2025 Annual Meeting, you will also be required to present proof of your ownership of our Common Stock on the record date, such as a bank or brokerage account statement or a letter from your broker or bank reflecting your ownership of our Common Stock as of the record date, to be admitted to the 2025 Annual Meeting.

No cameras, recording equipment or electronic devices will be permitted in the 2025 Annual Meeting.

How are proxy card votes counted?

If the proxy card is properly signed and returned to us, and not subsequently revoked, it will be voted as directed by you. Unless contrary instructions are given, the persons designated as proxy holders on the proxy card will vote: “FOR” the Election of Directors Proposal, “FOR” the Auditor Ratification Proposal, “FOR” the Advisory Vote on Executive Compensation Proposal, “FOR” the Merger Proposal, “FOR” the Generating Alpha Issuance Proposal, “FOR” the Incentive Plan Increase Proposal, “FOR” the Authorized Common Stock Increase Proposal, “FOR” the Series C Conversion Proposal, “FOR” the Reverse Stock Split Proposal, and “FOR” the Adjournment Proposal; and as recommended by our Board with regard to any other matters that may properly come before the 2025 Annual Meeting, or, if no such recommendation is given, in their own discretion.

6

May I revoke my vote after I return my proxy card?

Yes. You may revoke a previously granted proxy and change your vote at any time before the taking of the vote at the 2025 Annual Meeting. If you are the record holder, you may change how your shares are voted or revoke your proxy by (i) filing with our Corporate Secretary a written notice of revocation or a duly executed proxy bearing a later date or (ii) voting during the 2025 Annual Meeting. For shares you hold beneficially, you may change your vote by following the instructions provided by your broker, bank or nominee.

Who pays the costs of soliciting proxies?

We will pay the costs of soliciting proxies, including preparation and mailing of the Notice, preparation and assembly of this Proxy Statement and the proxy card, coordination of the Internet and telephone voting process, and any additional information furnished to you by the Company. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of our Common Stock beneficially owned by others to forward to such beneficial owners. We may reimburse persons representing beneficial owners of shares of our Common Stock for their costs of forwarding solicitation materials to such beneficial owners. Original solicitation of proxies by Internet and mail may be supplemented by telephone, facsimile, or personal solicitation by our directors, officers or other regular employees without additional compensation. We may request by telephone, facsimile, mail, electronic mail or other means of communication the return of the proxy cards. In addition, we have retained D.F. King & Co., Inc. to aid in the solicitation of proxies for this year. We will pay D.F. King & Co., Inc. fees of not more than $12,500 plus expense reimbursement for its services. Please contact D.F. King & Co., Inc. toll-free at (800) 549-6697 with any questions you may have regarding our proposals.

Where can I find the voting results of the 2025 Annual Meeting?

We intend to announce preliminary voting results at the 2025 Annual Meeting and publish final results in a Current Report on Form 8-K, which will be filed within four (4) business days of the 2025 Annual Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four (4) business days after the 2025 Annual Meeting, we intend to file a Current Report on Form 8-K to publish preliminary results and, within four (4) business days after the final results are known to us, file an additional Current Report on Form 8-K to publish the final results.

Who will count the votes?

A representative of Broadridge Financial Solutions, Inc., our inspector of election, will tabulate and certify the votes.

You should rely only on the information provided in this Proxy Statement. We have not authorized anyone to provide you with different or additional information. You should not assume that the information in this Proxy Statement is accurate as of any date other than the date of this Proxy Statement or, where information relates to another date set forth in this Proxy Statement, then as of that date.

7

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information, to the best knowledge and belief of the Company, as of February 11, 2026 (unless provided herein otherwise), with respect to holdings of our common stock by (1) each person known by us to be the beneficial owner of more than 5% of the total number of shares of our common stock outstanding as of such date; (2) each of our directors; (3) each of our named executive officers; and (4) all of our directors and our executive officers as a group. The table is based on 9,609,436 shares of common stock issued and outstanding as of February 11, 2026.

Unless otherwise indicated the mailing address of each of the stockholders below is c/o Olenox Industries Inc., 1207 N. FM 3083 E. Bldg C, Conroe, Texas 77304. Except as otherwise indicated, and subject to applicable community property laws, except to the extent authority is shared by both spouses under applicable law, the Company believes the persons named in the table have sole voting and investment power with respect to all shares of common stock held by them. Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities.

|

Name of Beneficial Owner |

Shares of |

Percentage of |

||||

|

Paul M. Galvin, Former Chairman and Former Chief Executive Officer |

4,428 |

(1) |

* |

% |

||

|

Michael McLaren, Chief Executive Officer |

1,523,638 |

|

15.86 |

% |

||

|

Patricia Kaelin, Chief Financial Officer |

183 |

|

* |

|

||

|

Jim Pendergast, Chief Operating Officer |

0 |

|

* |

|

||

|

Jill Anderson, Director |

418 |

|

* |

|

||

|

Thomas Meharey, Director |

478 |

|

* |

|

||

|

Christopher Melton, former Director |

444 |

(2) |

* |

|

||

|

Samarth Verma, Director |

0 |

|

* |

|

||

|

All current executive officers, directors and nominees as a group (11 persons) |

1,523,638 |

|

15.87 |

% |

||

|

|

|

|||||

|

5% Stockholders other than executive officers and directors |

|

|

||||

____________

* Less than 1% ownership interest.

(1) Includes 669 shares of Common Stock held directly by Mr. Galvin and 1 share held by TAG Partners, LLC (“TAG”), an investment partnership formed for the purpose of investing in the Company. Mr. Galvin is a managing member of, and has a controlling interest in, TAG and may be deemed to beneficially own the share of Common Stock held by TAG, over which he has shared voting and dispositive power. Mr. Galvin disclaims beneficial ownership of the shares of Common Stock held by TAG except to the extent of his pecuniary interest therein. Also includes 19 options to purchase our presently exercisable Common Stock.

(2) Includes 1 share of Common Stock held in Mr. Melton’s retirement account, which Mr. Melton indirectly owns, and 69 shares of Common Stock held directly by Mr. Melton.

8

PROPOSAL 1: ELECTION OF DIRECTORS

At the 2025 Annual Meeting, seven nominees will be elected as directors. The following persons: Michael McLaren, Adam Falkoff, Jill Anderson, Thomas Meharey, Paula J. Dobriansky, Erik Blum and Samarth Verma have been nominated by the Nominating, Environmental, Social and Corporate Governance Committee of the Board of Directors (the “Nominating Committee”) and the Board of Directors of the Company for election as directors of the Company at the 2025 Annual Meeting. The Board of Directors believes that it is in the best interests of the Company to elect the above-described nominees, each to serve as a director until the next annual meeting of stockholders and until his/her successor shall have been duly elected and qualified. All of the nominees have consented to being named in this proxy statement and to serve as a director if elected. At the time of the 2025 Annual Meeting, if any of the nominees named above is not available to serve as director (an event that the Board of Directors does not currently have any reason to anticipate), all proxies may be voted for any one or more other persons that the Board of Directors designates in their place. It is the intention of the persons named as proxies to vote all shares of Common Stock for which they have been granted a proxy for the election of each of the nominees, each to serve as a director until the next annual meeting of stockholders and until his/her successor shall have been duly elected and qualified.

The Board of Directors believes that each of the nominees is highly qualified to serve as a member of the Board of Directors and each has contributed to the mix of skills, core competencies and qualifications of the Board of Directors. When evaluating candidates for election to the Board of Directors, the Nominating Committee and the Board of Directors seeks candidates with certain qualities that it believes are important, including experience, skills, expertise, personal and professional integrity, character, business judgment, time availability in light of other commitments, dedication, conflicts of interest, those criteria and qualifications described in each director’s biography below and such other relevant factors that the Nominating Committee considers appropriate in the context of the needs of the Board of Directors.

Director Nomination Process

The Nominating Committee evaluates and recommends director nominees for the Board’s consideration. Each of the director nominees for the 2025 Annual Meeting was evaluated and recommended by the Nominating Committee and unanimously approved by the Board of Directors.

Director Qualifications

The Nominating Committee has not established specific criteria or minimum qualifications that must be met by director nominees, but recognizes the value of nominating candidates who bring a variety of experiences, skills, perspectives and backgrounds to the Board deliberations. When identifying nominees to serve as directors of the Company, the Nominating Committee, considers each nominee’s qualifications, including educational, business and professional experience, such as real estate, manufacturing and finance, and whether such nominee will satisfy the independence standards under The Nasdaq Capital Market and SEC rules and regulations. We do not have a set policy or process for considering diversity in identifying nominees, but strive to identity and recruit nominees with a broad diversity of experience, talents, professions, backgrounds, perspective, age, gender, ethnicity and country of citizenship, and who possess the commitment necessary to make a significant contribution to the Company. Board nominees should be committed to enhancing long-term stockholder value and should possess high standards of integrity and ethical behavior. The Nominating Committee may also consider other elements it deems appropriate.

We believe that the continuing service of qualified incumbent directors promotes stability and continuity in the function of the Board of Directors, contributing to the Board of Directors’ ability to work as a collective body, while giving us the benefit of the familiarity and insight into our affairs that our directors have accumulated during their tenure. Therefore, the Nominating Committee will generally re-nominate incumbent directors who continue to be qualified for Board of Directors service and are willing to continue in such role. If an incumbent director is not standing for re-election or if a vacancy occurs between annual stockholder meetings, the Nominating Committee will seek out potential candidates who meet the criteria for selection as a nominee and have the specific qualities or skills being sought for appointment to the Board of Directors. Director candidates will be selected based upon input from the members of the Board of Directors, senior management of the Company and, if the Committee deems it appropriate, a third-party search firm.

9

Stockholder Recommendations

We will also consider director candidates submitted in writing by stockholders. A stockholder who wishes to nominate a person for election must provide written notice to the Company in accordance with the procedures set forth in our Amended and Restated Bylaws. Among other requirements, such notification shall contain certain background information and the consent of each nominee to serve as one of our directors, if elected. Stockholder nominations for election to the Board of Directors for the 2026 Annual Meeting must be made by written notification. See “Stockholder Proposals For the 2026 Annual Meeting.”

All potential director candidates will be evaluated in the same manner, regardless of the source of recommendation.

2025 Nominees for Election as Directors

The following table sets forth the nominees to be elected at the 2025 Annual Meeting, each nominee’s age as of the Record Date, the year each nominee joined the Board of Directors and each nominee’s current position with the Company:

THE NOMINEES

|

Name of Director or Executive Officer |

Ages |

Position |

Served as an Officer |

|||

|

Michael McLaren(7) |

62 |

Chairman of the Board, |

January 2025 |

|||

|

Jill Anderson(2)(3)(5) |

50 |

Director |

May 2021 |

|||

|

Adam Falkoff |

57 |

Director |

Nominee |

|||

|

Thomas Meharey(4) |

42 |

Director |

August 2023 |

|||

|

Samarth Verma(1)(3)(6) |

47 |

Director |

May 2025 |

|||

|

Paula J. Dobriansky |

70 |

Director |

Nominee |

|||

|

Erik Blum |

60 |

Director |

Nominee |

____________

(1) Audit Committee Member

(2) Audit Committee Chair

(3) Compensation Committee Member

(4) Compensation Committee Chair

(5) Nominating, Environmental, Social and Governance Committee Member

(6) Nominating, Environmental, Social and Governance Committee Chair

(7) Executive Committee Member

Michael McLaren was appointed as the Company’s Chief Executive Officer and a director of the Company in January 2025. Mr. McLaren has more than 30 years of leadership experience in the energy industry, including significant contributions to military and energy projects, field services, and mergers and acquisitions. He is the founder of several startups where he has led innovative energy solutions, manufacturing systems and is the developer and patent holder of an extensive catalog of energy and green technologies. Mr. McLaren earned a Master’s Degree in Science and a Master’s Degree in Business from the University of British Columbia.

We selected Mr. McLaren to serve on our Board because he brings extensive knowledge with respect to the Oil & Gas, Renewable Energy and Technology industries. Mr. McLaren’s pertinent experience, qualifications, attributes and skills include his expertise business, physics and science.

Jill Anderson was appointed as a director of the Company in August 2023. Ms. Anderson has over twenty years of in-house and law firm experience counseling life sciences and healthcare companies on a variety of business issues and transactions, including corporate, regulatory, data privacy and security, employment, marketing and sales, real estate and litigation matters. Since August 2020, Ms. Anderson has served as Chief Legal Officer and Privacy Officer of miR Scientific, a precision healthcare company committed to transforming cancer management globally by developing non-invasive tests for the detection and risk classification of cancers. From December 2006 to August 2020, Ms. Anderson was a partner in the Healthcare and Privacy & Cybersecurity departments at the law firm of Moses & Singer LLP in New York City. Before that, Ms. Anderson held legal roles at Dana-Farber Cancer Institute and Mass General Brigham (formerly Partners Healthcare System). Ms. Anderson also serves on the Board

10

of Directors of Fight Cancer Global, a nonprofit organization dedicated to creating patient-centric solutions which unite all constituents to end the isolation for cancer patients globally. Ms. Anderson successfully completed training at the 2023 Program on Corporate Compliance and Enforcement (PCCE) at NYU School of Law in Board Governance, Board Effectiveness, Risk Management, ESG and DEI. Ms. Anderson earned her J.D. at Widener University School of Law and holds a Bachelor of Science degree in Pre-Medicine from Rutgers University.

We selected Ms. Anderson to serve on our Board because she brings extensive knowledge with respect to the healthcare industry. Ms. Anderson’s pertinent experience, qualifications, attributes and skills include scientific expertise, managerial experience and the knowledge and experience she has attained through her healthcare experience.

Adam Falkoff was appointed as a director of the Company on February 3, 2026. Mr. Falkoff has over 20 years of experience in public policy, international relations, and business development and diplomacy. He has advised CEOs and Boards of the Fortune 100, Presidents, Prime Ministers, Cabinet Ministers and Ambassadors. He is a life member of the Council on Foreign Relations and a member of The Trilateral Commission. Mr. Falkoff is the President of CapitalKeys, a bipartisan global public policy and strategic consulting firm based in Washington D.C. with offices in London and Singapore. Mr. Falkoff has been serving as the Global Managing Partner of Strategic Ventures at Microsoft. Prior to Microsoft, he was the Global Head of Government Relations and Philanthropy at Amazon. Previously he served Chairman of the House International Relations Committee, Congressman Ben Gilman, and also served, in the United States Senate, Chairman of the Banking Committee Senator Alfonse D’Amato as professional staff and was the White House Liaison. Mr. Falkoff also served Vice President Dan Quayle. Mr. Falkoff is a recipient of the Ellis Island Medal of Honor, one of the nation’s highest honors, for achievement and inspired service to the United States. He was twice named to the Washington, D.C. Power 100, a list of the 100 most influential non-elected people in Washington, D.C. He was appointed by Secretary of State as a United States Public Diplomacy Envoy. Mr. Falkoff received a B.A. from Duke University and both an M.B.A. and M.I.M. (Master of International Management) from the Thunderbird School of Global Management.

Thomas Meharey was appointed as a director of the Company in October 2023. Mr. Meharey currently serves as a Vice President and board member for kathy ireland Worldwide, a global lifestyle company (“kiWW”). Mr. Meharey was appointed Vice President of kiWW in 2007 and as a board member of kiWW in 2017. During his time with kiWW, Mr. Meharey launched the MIVI Millennial brand for men and women alongside global lifestyle designer Kathy Ireland. From 2003 to 2007, Mr. Meharey served as the Director of kathy ireland Weddings and Resorts, where he managed a portfolio of properties in excess of $40 million dollars. In 2004, Mr. Meharey founded a general contracting business in Hawaii, where he managed projects ranging from modest homes to multi-million dollar estates. Mr. Meharey served our country as a marine from 1999-2003.

We selected Mr. Meharey to serve on our Board due to his leadership skills and experience, his expertise in scaling businesses and his knowledge of the luxury brand, advertising, real estate and construction industries.

Samarth Verma was appointed as a director of the Company on May 21, 2025. Mr. Verma currently serves as Co-Founder and Chairman of the Board of FansXR, where he has led the global product development and launch of immersive, real-time media broadcasting technologies. FansXR delivers live, fan-controlled broadcasts in 2D, 360, and animated environments for entertainment and sports gamification. Its platform leverages extended reality, augmented data overlays, and artificial intelligence to enhance digital streaming and asset creation, while integrating features such as betting, interactive data, and optimized hardware performance. Mr. Verma is a proven technology innovator and entrepreneur with a diverse background spanning immersive media, advanced mathematics, and corporate development across a range of sectors including hospitality, gaming, energy, and real estate. Mr. Verma’s background originated in research, and it encompasses the vast field of mathematics. At the age of nine, he published his first research paper in The Abstract of the American Mathematics Society’s Conjectures in Number Theory. He became a member of the Wisconsin Space Grant Consortium and worked on a NASA grant project as a student research associate. Mr. Verma attended the University of Wisconsin, Madison.

Paula J. Dobriansky was appointed as a director of the Company in November 2025. Ambassador Paula J. Dobriansky, a foreign policy expert and diplomat specializing in national security affairs, is Vice Chair of the Atlantic Council’ Scowcroft Center for Strategy & Security and Senior Fellow, Harvard University Belfer Center. She brings over 30 years of government and international experience across senior levels of diplomacy, business, and defense. She was Senior Vice President and Global Head of Government and Regulatory Affairs at Thomson Reuters and held the Distinguished National Security Chair at the U.S. Naval Academy. Her high-level government positions include Under Secretary of State for Global Affairs, President’s Envoy to Northern Ireland (for which she received

11

the Secretary of State’s highest honor — the Distinguished Service Medal, and National Security Council Director of European and Soviet Affairs). A member of the Council on Foreign Relations and the American Academy of Diplomacy, Dobriansky also served on the Defense Policy Board, the Secretary of State’s Foreign Policy Board and as Chair of ExIm Bank’s Council on China Competition. She has a BSFS summa cum laude from Georgetown University School of Foreign Service and an MA and Ph.D. in Soviet political/military affairs from Harvard University. She has received high-level international recognition from the governments of Poland, Ukraine, Hungary, Romania, Lithuania and Colombia and is the recipient of five honorary degrees.

Erik Blum was appointed as a director of the Company on February 3, 3026. Mr. Blum currently serves as Chief Executive Officer of Fynntechnical Innovations Inc (FYNN), where he has lead the corporate turnaround of a publicly traded company, taking FYNN from a nonreporting pink sheet status to a fully audited, fully reporting entity under the 1934 Act as of November 2023. With over 30 years’ experience in debt, corporate finance, and company management, Mr. Blum has extensive expertise in equity and debt markets. Beginning in 2001, Mr. Blum structured CMOs with a specialization in inverse floaters for Fannie Mae and Freddie Mac. In 2005, he created a reverse convertible bond desk for Stern Agee. He was a registered principal compliance offer for close to 27 years on Wall Street. He left Wall Street in 2010 to found JW Price LLC, a corporate consulting firm, which focused on providing business development services to microcaps and other small public companies. During his time at JW Price, Mr. Blum helped multiple companies become successful public trade entities. He has sat as CEO, CFO, and director of multiple companies and has been instrumental in enabling their turnaround.

Vote Required and Board of Directors’ Recommendation

The affirmative vote of a plurality of the votes cast, either in person or by proxy, at the 2025 Annual Meeting is required for the election of these nominees as directors. You may vote FOR or WITHHOLD authority to vote for each of the nominees for director. Withheld votes and broker non-votes, if any, will have no effect on the outcome of the vote as long as each nominee receives at least one FOR vote.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THE SEVEN NOMINEES LISTED ABOVE AS DIRECTORS

12

CORPORATE GOVERNANCE

Stockholder Communications with Directors

The Board of Directors has established a process to receive communications from stockholders. Stockholders may contact any member or all members of the Board of Directors, any Board committee, or any chair of any such committee by mail. To communicate with the Board of Directors, any individual director or any group or committee of directors, correspondence should be addressed to the Board of Directors or any such individual director or group or committee of directors by either name or title. All such correspondence should be sent “c/o Corporate Secretary” at Olenox Industries Inc., 1207 N. FM 3083 E. Bldg C, Conroe, Texas 77304.

All communications received as set forth in the preceding paragraph will be opened by the office of our Corporate Secretary and the Corporate Secretary’s office will make sufficient copies of the contents to send to each director who is a member of the group or committee to which the envelope or e-mail is addressed. The Board of Directors has instructed the Corporate Secretary to forward stockholder correspondence only to the intended recipients and has also instructed the Corporate Secretary to review all stockholder correspondence and, in the Corporate Secretary’s discretion, refrain from forwarding any items deemed to be of a commercial or frivolous nature or otherwise inappropriate for the Board of Directors’ consideration. Any such items may be forwarded elsewhere in our company for review and possible response.

Board Leadership Structure

The Board recognizes that one of its key responsibilities is to evaluate and determine its optimal leadership structure to provide independent oversight of management. Our Board is currently led by a Chair of the Board who also serves as our Chief Executive Officer. The Board understands that the right Board leadership structure may vary depending on the circumstances, and our independent directors periodically assess these roles and the Board leadership to ensure the leadership structure serves the best interests of the Company and stockholders.

Mr. McLaren currently holds the Chairman and Chief Executive Officer roles. Prior to his resignation, effective January 31, 2026, Christopher Melton served as the Lead Independent Director appointed by the majority of the Board. The Board is in the process of identifying a replacement Lead Independent Director.

The responsibilities of the Lead Independent Director include, among others: (i) serving as primary intermediary between non-employee directors and management; (ii) approving the agenda and meeting schedules for the Board; (iii) advising the Chairman of the Board as to the quality, quantity and timeliness of the information submitted by management to directors; (iv) recommending director candidates and selections for the membership and chairman position for each committee of the Board; (v) calling meetings of independent directors; and (vi) serving as liaison for consultation and communication with stockholders.

We believe the current leadership structure, with combined Chair and Chief Executive Officer roles and a Lead Independent Director, best serves the Company and its stockholders at this time. Mr. McLaren possesses detailed and in-depth knowledge of the Company and the industry and the issues, opportunities and challenges we face, and is best positioned to ensure the most critical business issues are brought for consideration by the Board. In addition, having one leader serving as both the Chair and Chief Executive Officer provides decisive, consistent and effective leadership, as well as clear accountability to our stockholders and customers. This enhances our ability to communicate our message and strategy clearly and consistently to our stockholders, employees, customers and suppliers, particularly during times of turbulent economic and industry conditions. The Board believes the appointment of a strong Lead Independent Director and the use of regular executive sessions of the non-management directors, along with a majority the Board being comprised of independent directors, allow it to maintain effective oversight of management. We believe that the combination of the Chair and Chief Executive Officer roles is appropriate in the current circumstances and, based on the relevant facts and circumstances, separation of these offices would not serve our best interests and the best interests of our stockholders at this time.

13

Director Independence

Nasdaq Listing Rule 5605 requires a majority of a listed company’s board to be comprised of independent directors. In addition, the Nasdaq Listing Rules require that, subject to specified exceptions, each member of a listed company’s audit and compensation committees be independent under the Exchange Act. Members of the Audit Committee and Compensation Committee must also satisfy the independence criteria set forth in Rules 10A-3 and 10C-1 under the Exchange Act, respectively. Under Nasdaq Listing Rule 5605(a)(2), a director will only qualify as an “independent director” if, in the opinion of the Board, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In order to be considered independent for purposes of Exchange Act Rule 10A-3, an Audit Committee member may not, other than in his or her capacity as a member of the Audit Committee, the Board or any other committee of the Board, accept, directly or indirectly, any consulting, advisory or other compensatory fee from the Company or any of its subsidiaries, or otherwise be affiliated with the Company or any of its subsidiaries. In order for Compensation Committee members to be considered independent for purposes of Exchange Act Rule 10C-1, the Board must consider all factors specifically relevant to determining whether a director has a relationship to the Company that is material to that director’s ability to be independent from management in connection with the duties of a Compensation Committee member, including, but not limited to: (1) the source of compensation of the director, including any consulting advisory or other compensatory fee paid by the Company to the director; and (2) whether the director is affiliated with the Company or any of its subsidiaries or affiliates.

The Board has reviewed the materiality of any relationship that each of our directors has with the Company and has determined that each of Messrs. Dobriansky, Verma, Meharey, Falkoff, Blum and Ms. Anderson, is considered to be “independent” in accordance with the Nasdaq Listing Rules. Mr. McLaren is not considered “independent” due to his executive position with the Company. As such, independent directors comprise a majority of our Board, and the members of our Audit, Compensation, and Nominating, Environmental, Social and Corporate Governance Committees are fully independent.

Board and Committee Responsibilities

Generally

The Board is in charge of most decisions of the Company, except with respect to those matters to be decided by the stockholders. The Board selects the Chief Executive Officer and other members of the senior management team, who are in charge of conducting the Company’s day-to-day business. The Board acts as an advisor and counselor to senior management and ultimately monitors its performance. The function of the Board to monitor the performance of senior management is facilitated by the presence of non-employee directors who have substantive knowledge of the Company’s business.

Our Board has established a separate standing Audit Committee, Compensation Committee and Nominating, Environmental, Social and Corporate Governance Committee. Each of the Audit Committee, Compensation Committee and Nominating, Environmental, Social and Corporate Governance Committee operates pursuant to a written charter, a copy of which may be viewed on the Company’s website at https://www.safeandgreenholdings.com under the “Investors — Governance” tab.

14

Committees of the Board of Directors

The Board of Directors has a standing Audit Committee, Compensation Committee, Nominating, Environmental, Social and Corporate Governance Committee, and Executive Committee. The following table shows the directors who are currently members or Chairman of each of these committees.

|

Board Members |

Audit |

Compensation |

Nominating |

Executive |

||||

|

Samarth Verma |

Member |

Member |

Chair |

— |

||||

|

Michael McLaren |

— |

— |

— |

Member |

||||

|

Jill Anderson |

Member |

Member |

— |

— |

||||

|

Thomas Meharey |

— |

Chair |

— |

Member |

||||

|

Erik Blum |

Chair |

— |

— |

— |

||||

|

Adam Falkoff |

— |

— |

— |

— |

||||

|

Paula J. Dobriansky |

— |

— |

— |

— |

Audit Committee

Prior to Christopher Melton’s resignation, effective January 31, 2026, the members of our Audit Committee were Mr. Melton, who served as chairperson, Mr. Verma and Ms. Anderson. The Audit Committee Charter requires that the Audit Committee consist of at least three members of the Board, each of whom is required to be independent as defined by Nasdaq and SEC rules. The Board has determined that each member of the Audit Committee is independent, as defined by Rule 10A-3 of the Exchange Act and Nasdaq Listing Rule 5605(a)(2). The Board has identified director Erik Blum as an “audit committee financial expert,” as defined in Item 407(d)(5) of Regulation S-K under the Exchange Act, to replace Mr. Melton.

The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of our independent registered public accounting firm. Functions of the Audit Committee include, but are not limited to, reviewing the results and scope of the audit performed, and the financial recommendations provided by, our independent registered public accounting firm and coordinating the Board’s oversight of our internal financing and accounting processes.

All audit services to be provided to the Company by our independent public accounting firm, are pre-approved by the Audit Committee prior to the initiation of such services (except for items exempt from pre-approval requirements under applicable laws and rules). The Audit Committee approved all services provided by our independent public accounting firms to us during 2023 and 2024.

Compensation Committee

The members of our Compensation Committee are Mr. Meharey, who serves as chairperson, Ms. Anderson and Mr. Verma. The Compensation Committee Charter requires that the Compensation Committee consist of at least two members of the Board, each of whom is required to be independent as defined by Nasdaq rules. The Board has determined that each member of the Compensation Committee is independent, as defined in Nasdaq Listing Rule 5605(a)(2).

Functions of the Compensation Committee, include, but are not limited to: reviewing and approving, or recommending the Board to approve, compensation arrangements for our executive officers, including salary and payments under the Company’s equity-based plans; reviewing compensation for non-employee directors and recommending changes to the Board; and administering our stock compensation plans. Our principal executive officer annually reviews the performance of each of the named executive officers and other officers and makes recommendations regarding the compensation of the named executive officers and other officers and managers of the company, while the Compensation Committee reviews the performance of our principal executive officer. The conclusions and recommendations resulting from our principal executive officer’s review are then presented to the Compensation Committee for its consideration and approval. The Compensation Committee can exercise its discretion in modifying any of our principal executive officer’s recommendations. The Compensation Committee may delegate its authority to a subcommittee of its members.

15

In performing its functions, the Compensation Committee may retain or obtain the advice of compensation consultants, legal counsel and other advisors.

Nominating, Environmental, Social and Corporate Governance Committee

Prior to Christopher Melton’s resignation, effective January 31, 2026, the Nominating, Environmental, Social and Corporate Governance Committee was comprised of Mr. Verma, who serves as chairperson, and Mr. Melton. The Nominating, Environmental, Social and Corporate Governance Committee Charter requires that the Nominating, Environmental, Social and Corporate Governance Committee consist of at least two members of the Board, each of whom is required to be independent as defined by Nasdaq rules. The Board has determined that each member of the Nominating, Environmental, Social and Corporate Governance Committee is independent, as defined in Nasdaq Listing Rule 5605(a)(2). The Board is in the process of identifying a replacement for Mr. Melton. Specific responsibilities of the Nominating, Environmental, Social and Corporate Governance Committee include: (i) considering and recommending candidates for election to the Board; (ii) considering recommendations and proposals submitted by stockholders in respect of Board nominees, establishing policies in respect of such recommendations and proposals (including stockholder communications with the board of directors), and recommending any action to the Board in respect of such stockholder recommendations and proposals; (iii) identifying, evaluating and recommending candidates to serve on committees of the Board; (iv) assessing the performance of the Board; (v) reviewing the Company’s sustainability and societal impact and (vi) reviewing risk governance structure, risk assessment and risk management practices and guidelines, policies and processes for risk assessment and risk management, including cyber security measures.

Role of the Board in Risk Oversight

Our executive officers are responsible for the day-to-day management of risks the Company faces, while our Board has an advisory role in the Company’s risk management process, as a whole and at the committee level, and, in particular, the Board is responsible for monitoring and assessing strategic and operational risk exposures, including cybersecurity risk. The Board and committees rely on the representations of management, the external audit of our financial and operating results, our systems of internal control and our historic practices when assessing the Company’s risks. The Audit Committee oversees management of financial risk exposures and the steps that management has taken to monitor and control these exposures, and additionally provides oversight of internal controls. The Compensation Committee, in conjunction with the Audit Committee, assesses and monitors whether any of the Company’s compensation policies and programs have the potential to encourage excessive risk-taking. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed about such risks by committee reports, as well as advice and counsel from expert advisors.

Family Relationships

There are no family relationships between the directors of the Board or any of the executive officers of the Company.

Conduct of Board Meetings

The Chairman sets the agenda for Board meetings with the understanding that the Board is responsible for providing suggestions for agenda items that are aligned with the advisory and monitoring functions of the Board. Agenda items that fall within the scope of responsibilities of a committee of the Board are reviewed with the chair of that committee. Any member of the Board may request that an item be included on the agenda. Board materials related to agenda items are provided to Board members sufficiently in advance of Board meetings to allow the directors to prepare for discussion of the items at the meeting. At the invitation of the Board, members of senior management recommended by the Chairman attend Board meetings or portions thereof for the purpose of participating in discussions.

16

Code of Business Conduct and Ethics

Our Board has adopted a Code of Business Conduct and Ethics that applies to all of our employees, officers and directors, including our principal executive officer, principal financial officer and principal accounting officer. The Code of Business Conduct and Ethics is posted on our website at https://www.safeandgreenholdings.com under the “Investors — Governance” tab, and is available free of charge, upon request to our Corporate Secretary at Olenox Industries Inc., 1207 N. FM 3083 E. Bldg C, Conroe, Texas 77304; telephone number: (936) 323-6332. Any substantive amendment of the Code of Business Conduct and Ethics, and any waiver of the Code of Business Conduct and Ethics for executive officers or directors, will be made only after approval by the Board or a committee of the Board and will be disclosed on our website. In addition, any such waiver will be disclosed within four days on a Form 8-K filed with the SEC if then required by applicable rules and regulations.

Insider Trading Policy

We have

The insider trading policy prohibits, among other things, insider trading and certain speculative transactions in our securities (including short sales, buying put and selling call options and other hedging or derivative transactions in our securities) and establishes a regular blackout period schedule during which directors, executive officers, employees, and other covered persons may not trade in our securities, as well as certain pre-clearance procedures that directors and executive officers must observe prior to effecting any transaction in our securities.

We believe that the insider trading policy is reasonably designed to promote compliance with insider trading laws, rules and regulations, and listing standards applicable to us. A copy of the insider trading policy is filed as Exhibit 19.1 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2024.

Anti-Hedging and Anti-Pledging Policy

We maintain an insider trading policy that applies to our officers and directors that prohibits trading our securities when in possession of material non-public information. It also prohibits the hedging of our securities, including short sales or purchases or sales of derivative securities based on our securities, and, unless an exemption is approved by our Audit Committee, the pledging of our securities. Since the adoption of our insider trading policy, the Audit Committee has not granted any such exemptions to the policy’s general prohibition on pledging.

Ad Hoc Committees

From time-to-time we establish ad hoc committees to address particular matters.

Board and Committee Meetings

During the fiscal year ended December 31, 2024, the Board of Directors held 16 meetings. During the fiscal year ended December 31, 2024, our Audit Committee, Compensation Committee and Nominating, Environmental, Social and Corporate Governance Committee met four times, five times, and six times, respectively. Each of our incumbent directors that were directors during our fiscal year ended December 31, 2024 attended no less than 75% of the meetings of the Board of Directors and Board committees on which such director served during 2024.

Director Attendance at Annual Meetings

Our directors are encouraged, but not required, to attend the Annual Meeting of Stockholders. Paul Galvin, Christopher Melton, Thomas Meharey and Jill Anderson attended the 2024 Annual Meeting of Stockholders in person.

17

DIRECTOR COMPENSATION

Our director compensation program is designed to attract and retain highly qualified directors and align their interests with those of our stockholders. We compensate directors who are not employed by the Company with a combination of cash and equity awards. Mr. Galvin did not receive any compensation for serving on our Board in 2024.